Privacy Notice for California Residents

Effective Date: January 1, 2020

Last Reviewed: April 2020

Your privacy is important to us! This Privacy Notice for California Residents supplements the information contained in Dollar Loan Center’s Privacy Policy and applies solely to all visitors, users, and others who reside in the State of California (“consumers” or “you”). We adopt this notice to comply with the California Consumer Privacy Act of 2018 (CCPA) and any terms defined in the CCPA have the same meaning when used in this notice. By using this Website, you acknowledge and agree to the terms of this Policy.

All California consumers have rights under the CCPA regarding their personal information. Your rights are provided below along with the ways you can exercise these rights. Any information Dollar Loan Center (“we” or “us”) collects about you to originate, service, or collect on accounts you have with us is not covered by the CCPA but is covered by federal law, under the Gramm-Leach-Bliley-Act (GLBA) and our Notice of Financial Privacy Rights, which is provided separately.

Right to Know the Personal Information We Collect About You

We collect information that identifies, relates to, describes, or could reasonably be linked, directly or indirectly, with a particular consumer (“personal information”). We obtain personal information in connection with providing a financial product or service to you. Personal information does not include:

- Publicly available information from government records.

- De-identified or aggregated consumer information.

- Information excluded from the CCPA’s scope, like:

- Personal information covered by certain sector-specific privacy laws, including the Fair Credit Reporting Act (FCRA), the Gramm-Leach-Bliley Act (GLBA) or California Financial Privacy Act (FIPA), and the Driver’s Privacy Protection Act of 1994 (DDPA).

We may collect personal information about you from the following sources:

- Personal identifying information we receive from you on applications or other loan forms, such as your name, address, social security number, income, checking account information, and employment information.

- Information you provide us through our Website, including your name, e-mail, cell phone and home telephone numbers, regardless of whether you apply for a loan.

- Information about your transactions with our affiliates or others, such as your loan and payment history. Information we receive from a consumer reporting agency.

- Audio, electronic, and visual information as we monitor activity in our stores and on phone calls to our call center to ensure our customer service meets our high standards and to manage the security of our physical locations.

We may also collect and/or track the following information: Web page http headers, home server domain names, IP addresses, type of computer, type of Web browser, information from third-party Web analysis programs, information you provide us through applications, on-line forms, registration forms, surveys, and/or other entries, such as e-mail addresses, personal, financial, or demographic information, information on what pages our visitors access, and e-mail addresses of visitors that communicate with us via e-mail.

Our website is not directed at children under the age of thirteen, nor do we knowingly collect or maintain information from children under the age of thirteen. You must be at least eighteen years of age to obtain a loan from us.

How We Use Your Information

By using our Website, you give permission for us to use your information to gather from third-parties other information about you, such as your Social Security Number, where such information was incompletely or improperly filled out on our form(s). Such third-parties include but are not limited to, consumer reporting agencies and consumer credit bureaus. We may use any and all information that we gather from you and from such third-parties to check your credit history, credit record, and to evaluate your creditworthiness. If you choose to supply us with information, such as your Social Security Number, we may use that information to determine your financial standing. If you do not provide such information, we may also use other information that you provided for the purpose of verifying your eligibility for a loan or for any other programs, offer, or services. Upon qualification, your loan-specific financial information will be stored and utilized in accordance to the terms of our Privacy Policy.

We may also use personal information about you for the following reasons:

- Provide, maintain and improve our Services

- Provide and deliver the products and services you request, process transactions, and send you related information, including confirmations and receipts

- Send you technical notices, updates, security alerts, and support and administrative messages

- Respond to your comments, questions, and requests to provide customer service

- Communicate with you about products, services, offers, promotions, rewards, and events offered by us and others, and provide news and information we think will be of interest to you

- Monitor and analyze trends, usage and activities in connection with our Services

- Personalize and improve the Services and provide advertisements, contents or features that match user profiles or interest

- Process and deliver contest or promotion entries and rewards

- Link or combine with information we get from others to help understand your needs and provide you with better service

- Carry out any other purpose for which the information was collected.

- Enhance your experience at our site and to enable us to present content we think you might be interested in

- Use of your contact information to provide you information about our company and promotional material from us or our partners

- Improve our site, for statistical analysis, for marketing and promotional purposes, and for editorial or feedback purposes for our advertisers.

Information collected by us may be added to our databases and used for future communication regarding site updates, new products and services, and upcoming events.

When you give us your email address, you are agreeing to receive email messages from us, including marketing or promotional messages.

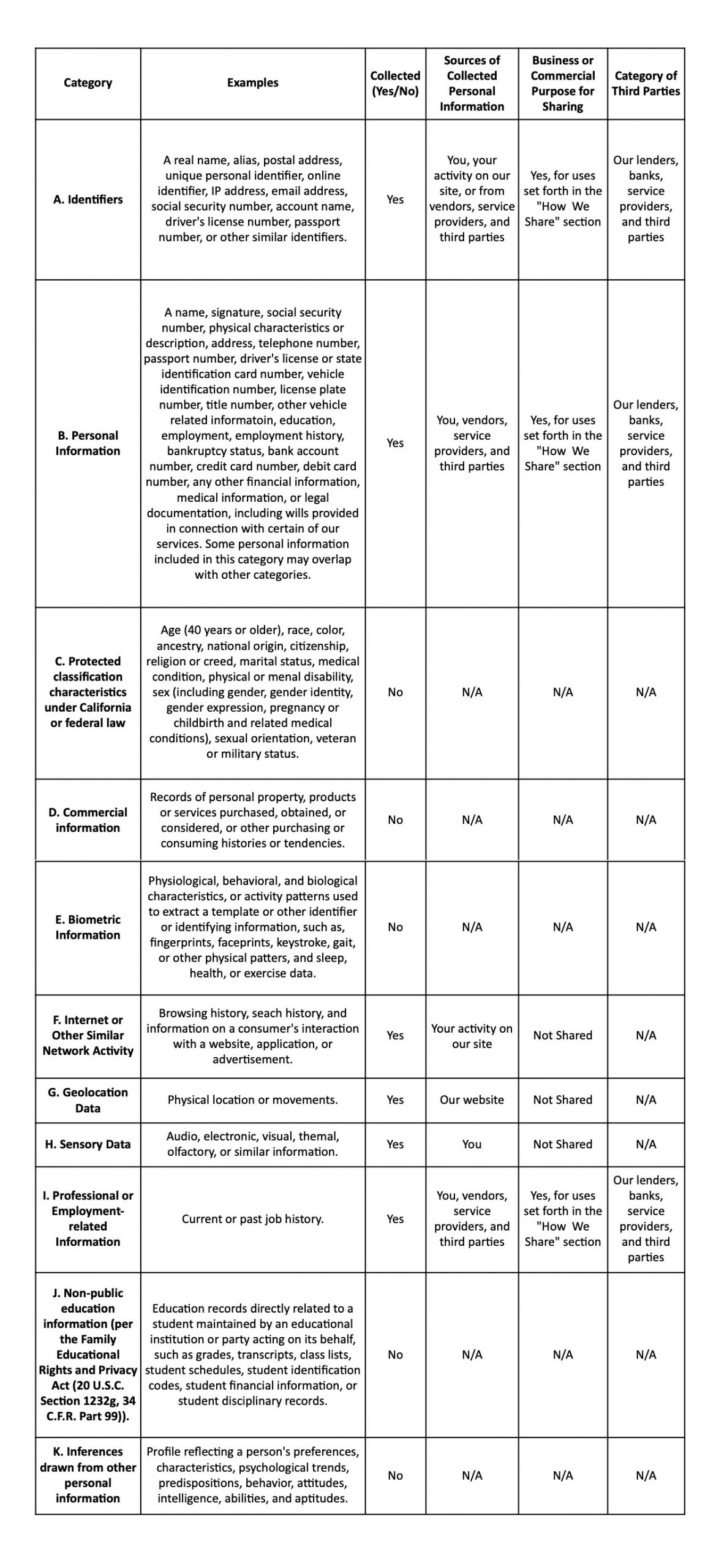

Categories of Personal Information Collected

Within the last 12 months, we collected the categories of personal information listed below and shared it as follows:

How We Share Your Information

If we are not licensed to provide loans in your state, and you ask us to forward your personal information to a licensed lender, we will share your information with one or more lenders who offer loans in your state. We may also share your personal information as allowed or required by law. We may also disclose all of the information we collect as described above to companies that perform marketing services on our behalf or to other financial institutions with whom we have joint marketing agreements. We may share your information with one or more unaffiliated companies who perform certain services for us and on our behalf. These services include, among others, data processing and management. These services allow us to contact you and provide you with information about our company and promotional materials that may be of interest to you. You give us your consent to share your information for these purposes. Except to the extent prohibited by law, we may continue to share information as described in this paragraph, unless you have opted out, as provided below.

Additionally, we may use or share the information we collect with affiliated companies in our corporate family. These are companies related by common ownership or control and can be financial and nonfinancial companies. Our affiliates include companies doing business under the trade names Dollar Loan Center, and financial companies such as DLC Empire, LLC. We may share your information with our affiliates so that they can solicit and market products and services to you. However, you have the right to opt-out of us sharing your information with our affiliates so that our affiliates can solicit and market products and services to you. You also have the right to opt-out of us sharing information with our affiliates about your creditworthiness.

We may also share your personal information with non-affiliated third parties. Non-affiliated third parties who may receive this information include mortgage and loan brokers, consumer lenders, small lenders, deferred presentment providers, check cashers, credit repair providers, supervised lenders, collection agencies, banks, credit and debit card providers, tax, preparers, payroll service providers, insurance agencies, bill payment agencies, ATM provers, marketing service providers (e.g., telemarketers), and financial service provider holding companies. You have the right to opt-out of us sharing your information with non-affiliated third parties.

Your Rights Under the California Consumer Privacy Act of 2018

The CCPA provides consumers (California residents) with specific rights regarding their personal information- the Right to Know, the Right to Delete, the Right to Opt-Out, and the Right to Non-Discrimination. This section describes your CCPA rights and explains how to exercise those rights, if applicable.

Right to Know: You have the right to request that we disclose certain information to you about our collection and use of your personal information over the past 12 months (“Right to Know”). Once we receive and confirm your verifiable consumer request for access, based on your request, we will disclose to you:

- the categories of personal information we collected about you;

- the categories of sources for the personal information we collected about you;

- our business or commercial purpose for collecting that personal information;

- the categories of third parties with whom we share that personal information;

- the specific pieces of personal information we collected about you; and

- with respect to disclosures of your personal information for a business purpose, the categories or personal information that each recipient obtained

We may deny your request for access if we are unable to verify your identity or have reason to believe that the request is fraudulent. We may also deny your request if the personal information is subject to an exemption under the FCRA, the GLBA, the FIPA, or the DPPA.

Right to Delete: You have the right to request that we delete any of your personal information that we collected and retained, subject to certain exemptions. Once we receive and confirm your verifiable consumer request, we will delete, de-identify, or aggregate your personal information (and direct our service providers to do the same), unless an exception applies.

In order to process your request, we must verify your identity. Once we receive your request, we will respond within 45 days. We will provide you with confirmation of what action we have taken. However, we will retain information about your request and how we complied.

We may deny your deletion request if the personal information is subject to an exemption under the FCRA, the GLBA, the FIPA, or the DPPA. Additionally, we may deny your request to delete if we are unable to verify your identity or have reason to believe that the request is fraudulent.

Right to Opt-Out: Under the CCPA, you have the right to opt-out of the sale of your personal information, not exempt under CCPA, with third parties. This right includes information that we may share with third parties for financial or non-financial consideration.

To exercise this right, you may call us toll-free at 1-866-550-4352, email us at info@dontbebroke.com, or use the Do Not Sell My Personal Information (CA Consumers) link. If you choose to email, please include your name, address, account number (if applicable), type Opt-Out in the subject line, and type any or all of the following statements, as applicable:

- Do not share information about my creditworthiness with your affiliates for their everyday business purposes

- Do not allow your affiliates to use my personal information to market to me

- Do not share my personal information with nonaffiliates to market their products and services to me

Note that even if you choose to exercise your right to opt-out of certain disclosures as described above, we may still contact you and retain your personal information as permitted by law. However, we will not share information covered by your opt-out request with our affiliates and non-affiliated third parties.

Right to Non-Discrimination: We will not discriminate against you for exercising any of your CCPA rights.

Submitting a Verified Consumer Request

To exercise the Right to Know and the Right to Delete described above, please submit a verifiable consumer request to us by either:

Calling us at 1-866-550-4352

Visiting www.dontbebroke.com and clicking on the Do Not Sell My Personal Information (CA Consumers) link located in the additional links section of the footer.

We are only required by the CCPA to respond to a Request to Know twice within a 12-month period. To constitute a verifiable consumer request, you must:

- Provide your full legal name, mailing address, date of birth, last 4 numbers of your Social Security Number or Dollar Loan Center account number if you have one, email address and/or telephone number; and

- Describe your request with sufficient detail that allows us to properly understand, evaluate, and respond to it.

We will respond to a verifiable consumer request within 45 days of its receipt. If we require more time (up to 45 additional days for a total of 90 days from receipt of the request), we will inform you of the reason and extension period in writing. We will deliver our written response by mail. Any disclosures we provide will only cover the 12-month period preceding the verifiable consumer request’s receipt. The response we provide will also explain the reasons we cannot comply with a request, if applicable.

How We Protect Your Information

We restrict access to public personal information about you to those employees who need to know that information to provide goods or services to you. We retain physical, electronic, and procedural safeguards that comply with federal regulations to guard your personal information.

Cookies

A cookie is an element of data that your Web browser can transfer to your computer’s hard drive to track your online activities, including the searches you conduct, the Web pages you visit, and the content you view, in an effort to deliver services and advertising targeted to your interests. There are pages on our Website that use cookies to track your online activities so that we can better serve you when you return to the Website. You agree to allow us to collect personal information, including but not limited to financial information, through the use of cookies. Any information collected through the use of cookies is subject to the terms of this Privacy Policy.

Additional Security Precautions

You also have a significant role in protecting your information. No one can see or edit the personal information you have shared with us on this Website without knowing your account information and password. If you use this Website, you are responsible for maintaining the confidentiality of your account, password, and restricting access to your computer. You agree to accept responsibility for all activities that occur under your account and password.

State Laws

Some states impose special requirements that apply to residents of those states. If you are a resident of one of those states, we may be required to follow procedures that differ from those described elsewhere in this Policy.

California Residents. Subject to certain exceptions allowed by law, we will not disclose to, or share your personal information with, any nonaffiliated third party unless we have obtained your prior written consent, and we will not disclose to or share your personal information with an affiliate unless we have notified you annually in writing that the personal information may be disclosed to our affiliates and you have not opted out of that disclosure.

Our Right to Change

We reserve the right to change this Privacy Policy at any time by providing you with a revised copy of the policy, notifying you of the existence and location of the revised policy, or by posting the changes online at our site.

Effective as of January 1, 2020

Live Phone Support

Live Online Support

Chat with an Online Specialist

*you may need to enable pop-ups in order to use this service.